By Steve Thorne

What would you do with unlimited funds, or what would you do if money didn’t matter? This is a question that is posed often but isn’t a fair question. Nobody can escape the necessity of money.

I have seen people that make well over $10,000 a month be slaves to their income and drowning in debt. I’ve also seen those in that income range that enjoy the goodness that life has to offer. There are others who make less than $3,000 a month who are barely making it from pay check to pay check and they live a very healthy and happy life. While some have more, and some have less, it really isn’t a matter of how much income you have, it is what you do with what you have.

In my house and my relationship with my partner, all conversations are meant to be open regardless of how difficult the topic. However, one of the most difficult conversations that we had for many years was that of “the Budget”. For a long time, we did not budget our money. We left it mostly to chance and reasonable management to not overspend our income. We were mostly lucky that the two of us don’t have extraordinary desires for “things”. However, with children progressing from youth to adolescence and into adult hood, our expenses rapidly grew out of control.

The reason we didn’t budget our money varied from being lazy to not wanting to be controlled. I, on one hand, didn’t want to put in the extra time to track the expenditures. My wife, on the other hand, didn’t want to live within certain restrictions for things she wanted to buy. However, we came to realize that our expenditures matched and sometimes exceeded our income. Again, we were not living extravagant lives. As we learned, everyone, including my wife and me, have a limited amount of income. And while we could work more, it became apparent that we needed to better control ourselves to stay within our monthly increase. We were failing to plan for the emergency items that had to be covered. Also, there were certain expenses that were very large, yet necessary, and they would come only periodically. For instance, the purchase of a car. A car is a typical need to get to and from work, required to get children to and from school and activities. Unfortunately, with a vehicle comes other expenses like insurance, gas, maintenance, etc. And if these are not planned for, these expenditures can lead to painful financial situations.

A Reality check: Everyone has a limited income and everyone has expenses. I’ve often joked that I’d love to be tested by having an income of $40,000/month. However, I’ve learned that there is a cost to that level of income. You don’t get $40,000/month by sitting at home watching tv or playing video games. It takes time and effort, and a bit of good will to build that kind of income. Often, the time and effort detract from other very important parts of life. Now I joke that you couldn’t pay me enough to do some jobs, even if they seem luxurious. Would I like to be President/CEO of a fortune 500 company? No way! I don’t want it, nor do I want the stress and pressure that come along with it. Sure, the pay would be nice, but there is a real cost to the income. For those that are or want to be President/CEO of a company, great! The world needs good leaders, and I am happy to support them. All of that said, even with $40,000/month income, it becomes just as easy to spend more than $40,000/month. For instance, winning the lottery seems like it would provide adequate amounts of cash and income. However, 70% of lottery winners end up broke, and a third go on to declare bankruptcy, according to the National Endowment for Financial Education[i]. Having a large amount of cash, or a large monthly income does not get anyone away from financial strains if they spend their money unwisely.

So where do you start? The first thing to do is to start tracking your expenditures… all of them! Gain knowledge about where your money is going. Write everything down, track it in a way that works for you, but make sure that you can go back and see what was spent, where it was spent, and why it was spent. You may end up being very surprised about where some of your money is going. And be honest with yourself. Hiding expenditures defeats the purpose. Track everything! This will set you up to start tracking the expenses once your budget is created.

What comes next? After tracking expenditures for a period, it will be time to create a realistic budget. Monthly living expenses can be tricky, but more manageable. Items like food and regular bills are easier to track but be careful. Realize that power bills go up and down as do gas bills. If you start tracking expenses in the spring, your energy bills will probably be at the lowest they will be all year. It will be important to consider expenses that fall outside of your tracking window. Expenses like taxes, insurance, annual gifts (i.e., birthdays, holidays, etc.), social gifts (spring/summer weddings are right around corner). If you are currently paying monthly payments for a car, that is easy to track. But what do you do with that money once the car is paid for? Hopefully, you continue to put that monthly amount into a future car payment. If you do that successfully, you will eventually get to the point where you can pay cash for a car (really, you can get to this point)! There have been situations that have caught our budget off guard. Scenarios like car accidents, appliances breaking down, and medical bills, to mention a few. These have ended up in our budget to plan for such future disasters. Having budgeted money in these categories has turned what would be super stressful situations into what is still very stressful, but without the financial strains. The money was available, and we did not need to go into debt to cover the extra costs.

And finish strong! Ok, there really isn’t a finish line. The budget doesn’t stop just like expenses don’t stop. Continue to track expenses, adjust the budget where necessary, and ensure that your expenses don’t extend past your income. Realize that if they do, then those expenses are cutting into other aspects of your life. There is no getting around this fact. It is reality, but you are on your way to managing your financial life better which will provide you with more freedom.

Really, more freedom? Absolutely! Reality is every person is a slave to money. It is the way the world works, and we are lucky to have the ability to work more (or less) as we want. If you can get the money working for you, and not against you, you will find freedoms that you did not have before the budget. That has been the case for my wife and me. We have found the balance between the time we work, and the time we spend with family, service, hobbies, and other outside interests. While we don’t have so much money that we can do whatever we want, which would be unrealistic, we have money enough for our needs and even a little more for our wants. And there is great freedom and peace in that statement.

Here are some of the budget categories that I have in our budget:

Basic: food, bills (gas, power, internet, cell phones, garbage, sewer, water, clothes, tv, taxes, insurance, misc.), medical/dental, donations, misc.

House: payment (or rent), yard, tools, upkeep, pet, misc.

Vehicles: gas, maintenance and future, registration/taxes, misc.

Kids: birthday, activities, school, misc.

Other: retirement, vacation, social gifts, holiday gifts, personal expense, rainy day, misc.

These will vary from case to case, and you need to personalize it to fit your needs. The amounts in each of these will also vary. At the end of the year, evaluate how the budget performed and adjust as necessary.

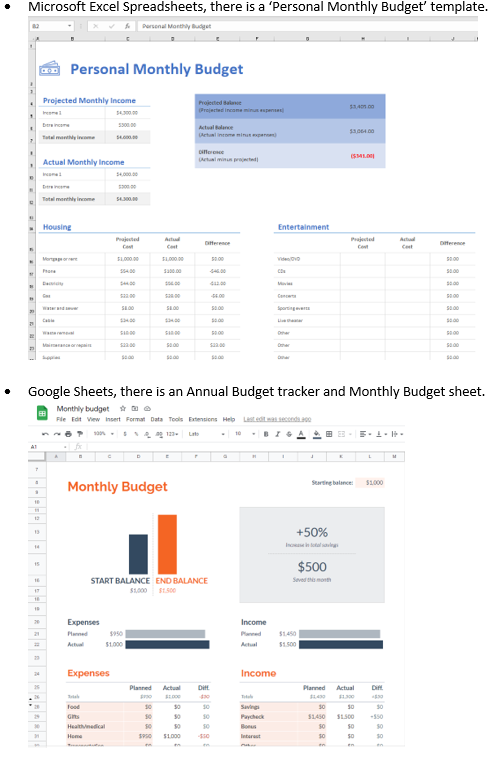

A couple of really good resources that you can start with are:

[i] https://www.lovemoney.com/gallerylist/64958/lottery-winners-who-won-millions-but-ended-up-with-nothing